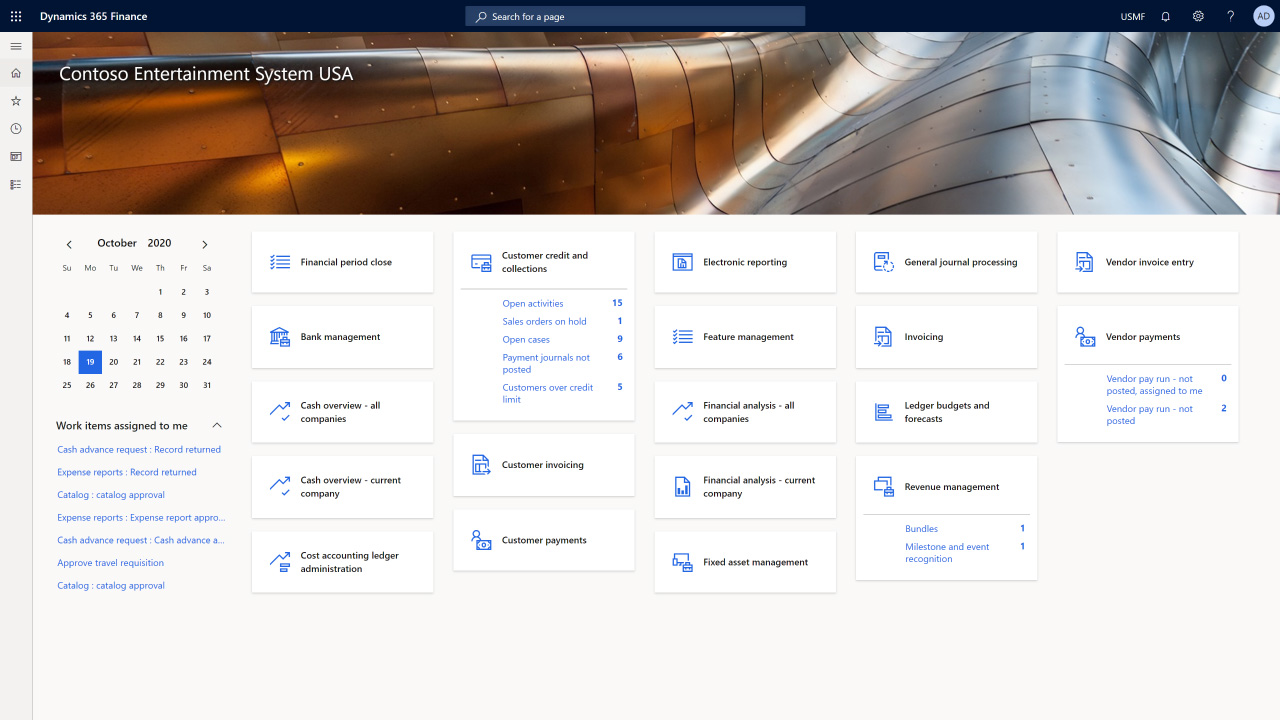

Dynamics 365 Finance

Monitor global financial operations in real time, predict outcomes, and make data-driven decisions to drive business agility and growth.

Enhance your financial decision making

Accurately project your cash flow; Actively monitor cash flow, identify current and future trends, and make data-driven decisions using finance insights, an intelligent and customizable cash flow–forecasting solution.

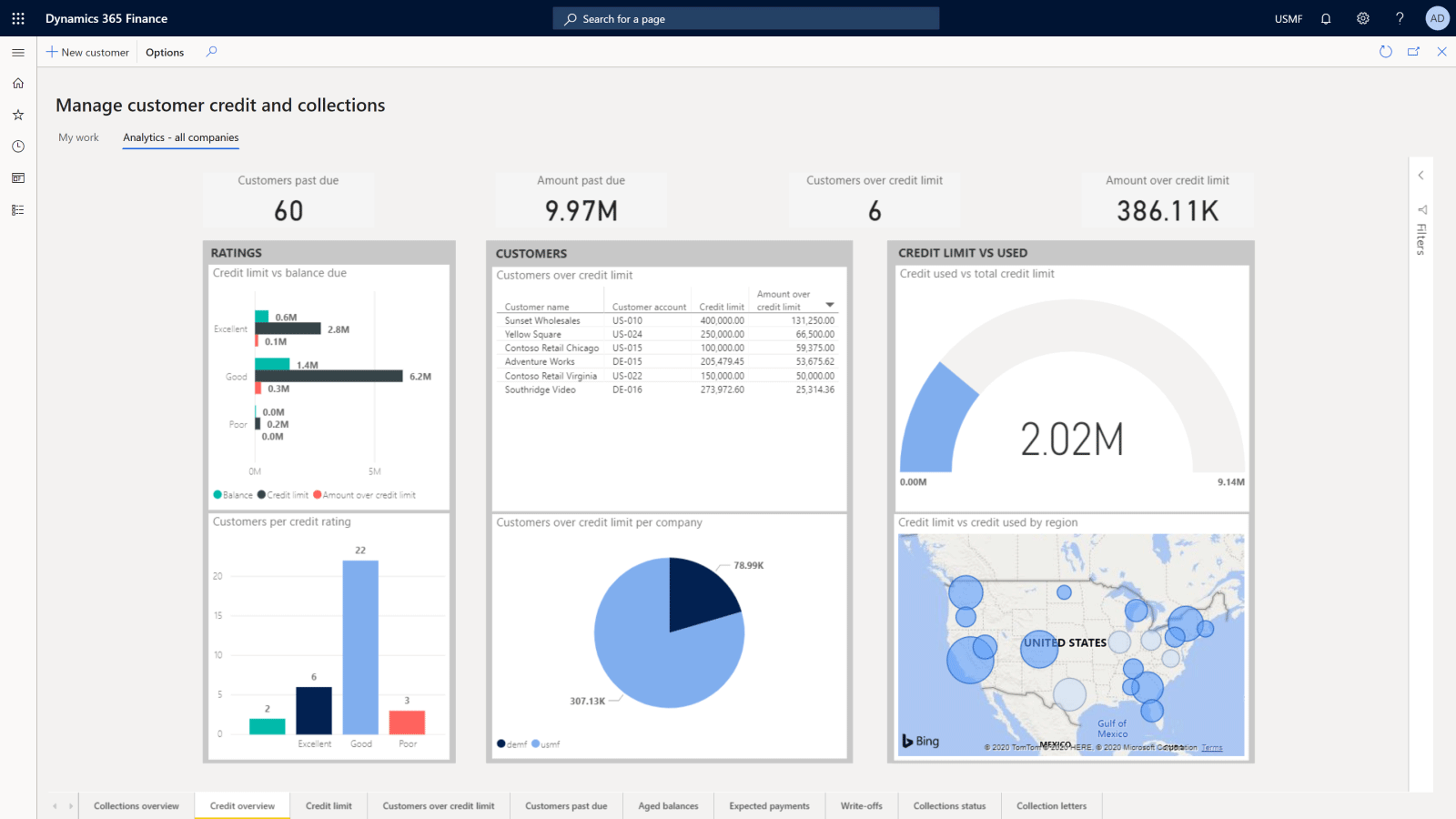

Reliably predict customer payments; Proactively reduce write-offs and improve your margin by predicting when (or whether) customers will pay their invoices.

Adapt quickly with intelligent budget proposals; Reduce the time and effort spent on budgeting. Use the intelligent budget proposal feature to consolidate and analyze years of historical data and create an accurate and robust budget proposal.

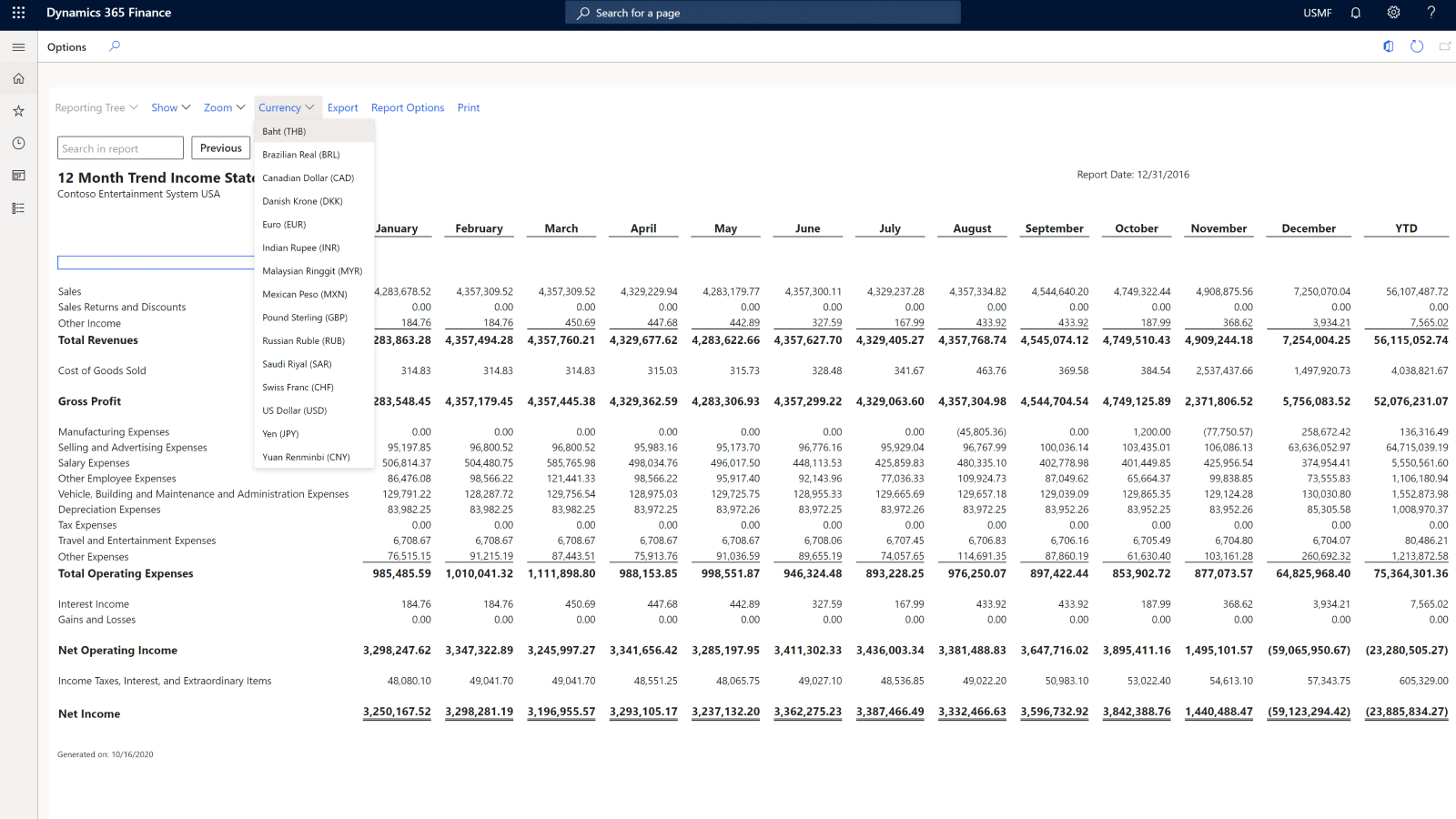

Close books faster and simplify financial management; Activate flexible, in-depth financial management, tags, and reporting that natively handle foreign exchange and support multiple legal entities and currencies in a single instance.

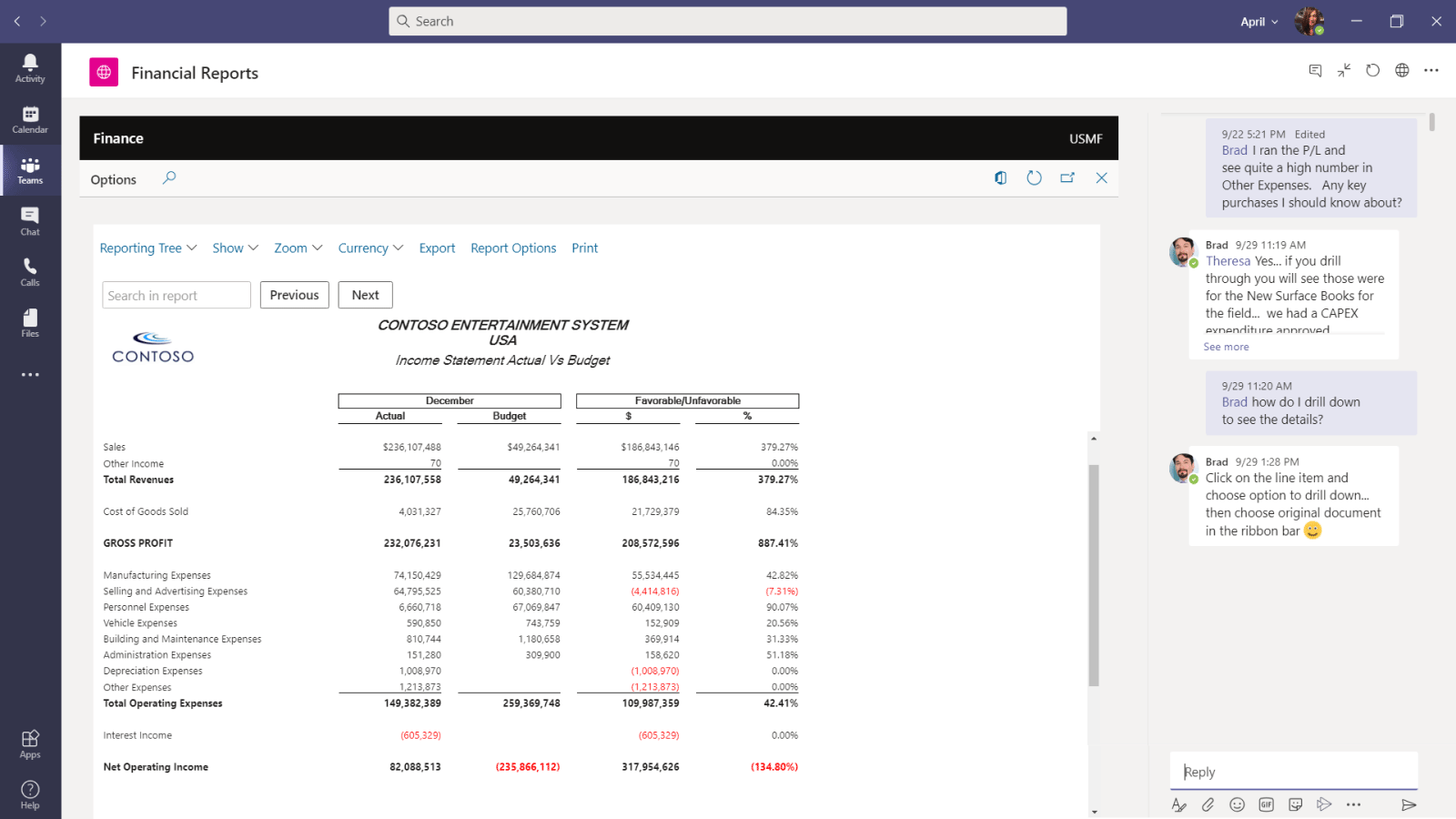

Connect business performance analytics; Make informed decisions using self-service analytics and reporting that provide timely insights by connecting data from other Dynamics 365 apps and outside sources.

Unify and automate your business processes

Automatically process vendor invoices; Save time and labor costs by automatically submitting invoices to workflow and matching vendor invoice lines to product receipts.

Effectively manage credit risks and collections; Create a rules- and prediction-based collection automation that helps increase on-time payment, improve cash flow, and save time.

Provide a single source of truth for business intelligence; Connect data and processes across Dynamics 365, Microsoft 365, and partner applications to create a centralized source of intelligent information for more effective cross-functional collaboration.

Make a strategic impact while reducing costs

Efficiently manage your growing business; Deploy new subsidiaries or product lines in record time. Copy an existing legal entity’s setup to a new entity with onboarding that’s quick, cost-effective, and consistent with the company’s best practices.

Thrive in a subscription-based economy; Use subscription billing to adapt to complex billing and pricing scenarios, gain actionable insights, and automate reporting for recurring revenue streams.

Increase workforce productivity; Automate menial tasks and prioritize important fiscal work with a solution that works seamlessly with Microsoft 365 and offers role-based workspaces and predictive insights.

Decrease global financial complexity and risk

Quickly adapt to changing regulatory requirements; Take advantage of a guided, rules-based chart of accounts and no-code/low-code globalization services to simplify tax calculation, electronic invoicing, regulatory reporting, and global payments.

Meet local and global business needs to scale faster; Accelerate global expansion and ensure compliance with localizations for 51 countries/regions and 67 languages. Use partner solutions from Microsoft AppSource to operate in more than 200 countries/regions.

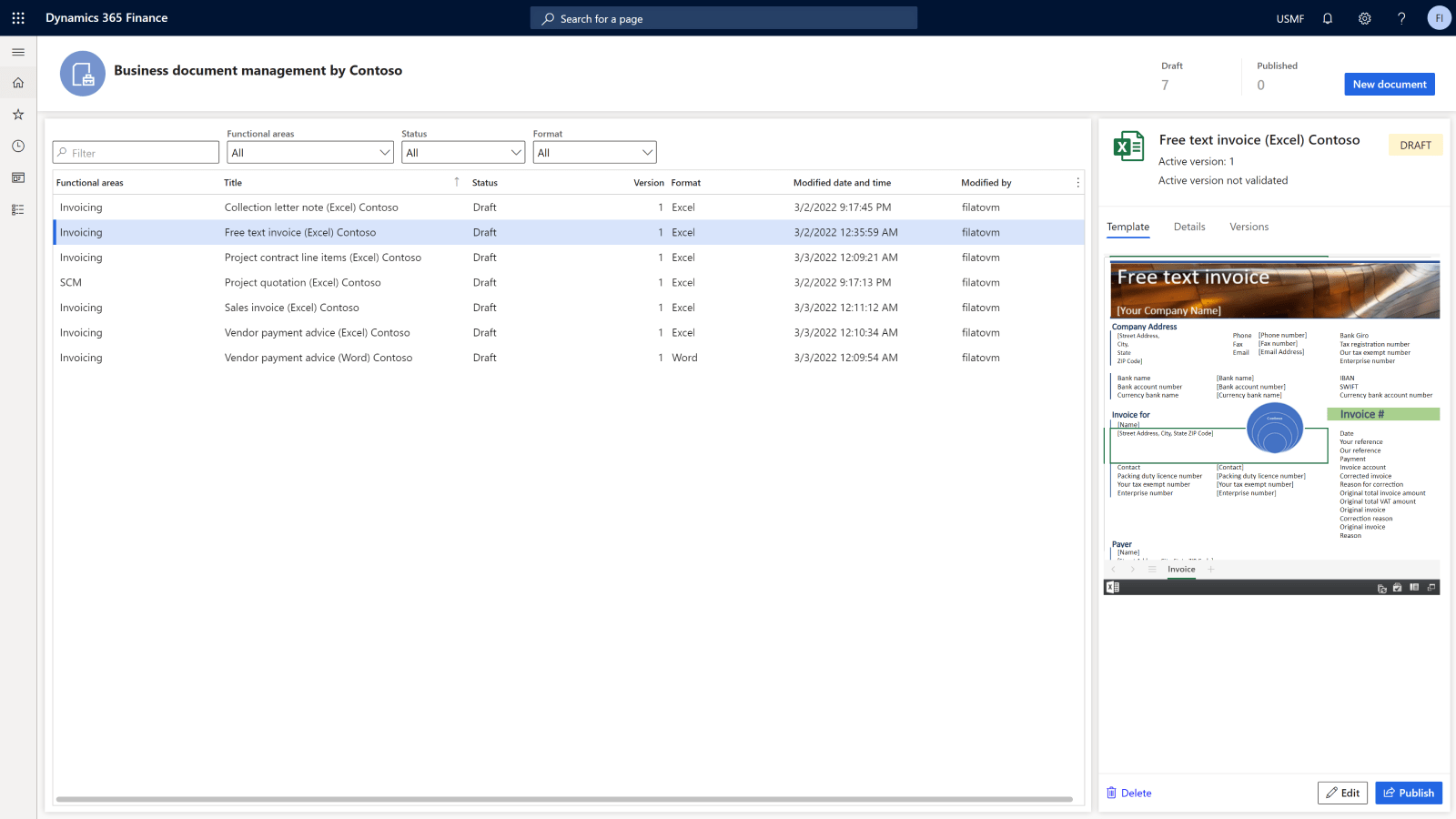

Minimize your need for customizations; Create configurable business documents with Microsoft 365 templates. Easily adapt to changing business and legal requirements without the need for expensive, time-consuming, and rigid code changes.

Accelerate invoice delivery; Go paperless, speed processes, and improve traceability with no-code, configurable electronic invoicing and automation workflows.

Comply with local tax regulations; Use a no-code, flexible tax-determination matrix and configurable tax-calculation formula designer to comply with local tax regulations and support complex tax scenarios.